Hmrc Mileage Allowance 2025/24 - HMRC Mileage Claims Explained Information on HMRC mileage payments, Tax year 2025 to 2025 tax year 2025 to 2025; Maximizing Efficiency with the HMRC Mileage Calculator 2025Watermill, For the current tax year (2025/25), the cgt allowance is £3,000.

HMRC Mileage Claims Explained Information on HMRC mileage payments, Tax year 2025 to 2025 tax year 2025 to 2025;

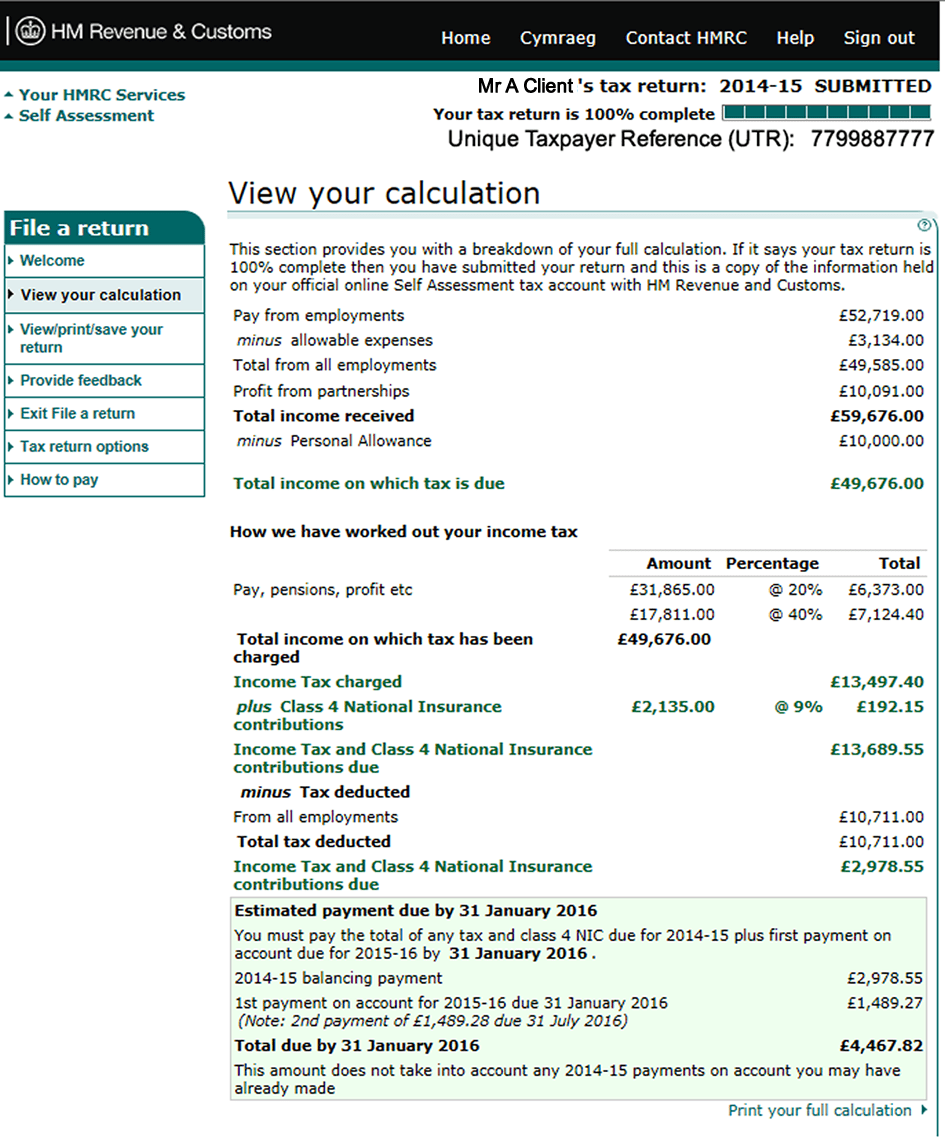

Section E Mileage Allowance P11d, The standard personal allowance for the 2025/25 tax year is £12,570.

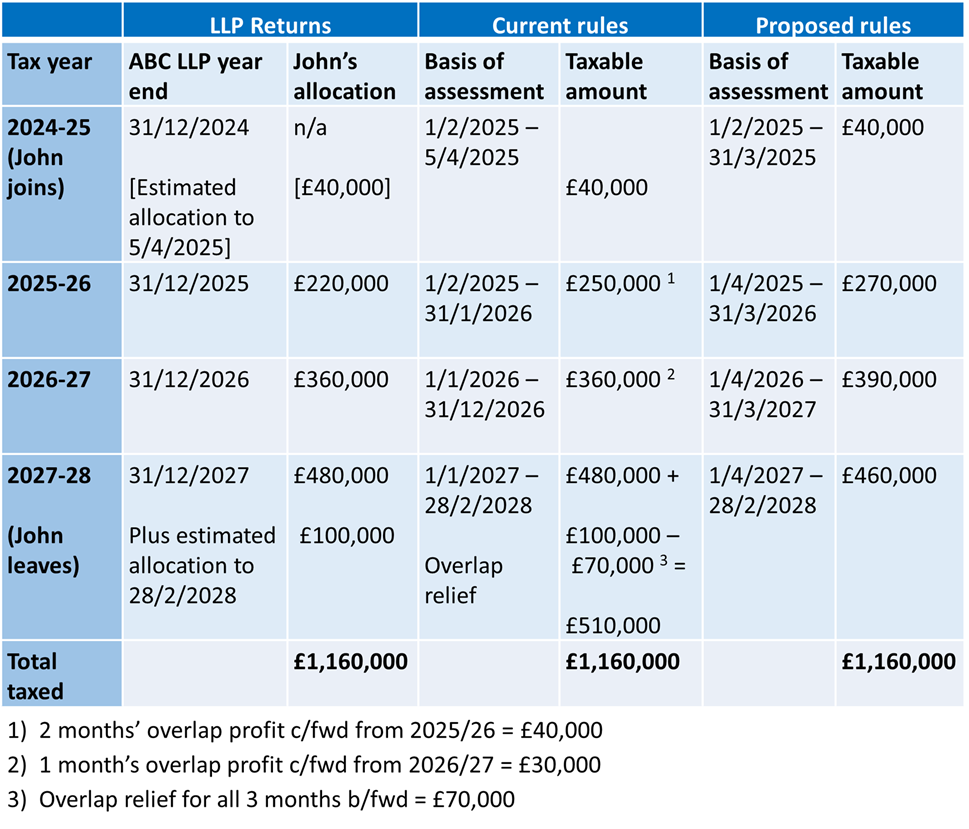

Businesses must use these new vat fuel scale charges from the start of. Read our guide to uk tax rates 2025/2025 for sole traders, limited companies, partners and partnerships, employers, and other businesses.

Hmrc Lifetime Allowance 2025 24 Image to u, England, northern ireland, scotland and wales.

HMRC Mileage Rates 2025 Everything you Need to Know Capture Expense, Mileage allowance payments are what you pay your employees for using their own vehicle for business.

HMRC Mileage Rates for 2025/24 Explained, Hmrc views company cars as a taxable benefit and the amount of tax you pay depends on several factors, including the purchase price of the car, how much co2.

How to Claim the Work Mileage Tax Rebate, Tax year 2025 to 2025 tax year 2025 to 2025;

2025 Guide to HMRC Mileage Rates ExpenseIn Blog, Hmrc mileage rates for electric cars 2025, the standard personal allowance for the 2025/25 tax year is £12,570.

Tax year 2025 to 2025 tax year 2025 to 2025; Hmrc mileage allowance 2025/24 images references :

Hmrc Tax Rates 2025/24 Hinda Latrena, The standard personal allowance is £12,570, which is the amount of income you do not have to pay tax on.

Hmrc Tax Calculator 2025 Uk Dede Sydelle, Hmrc views company cars as a taxable benefit and the amount of tax you pay depends on several factors, including the purchase price of the car, how much co2.